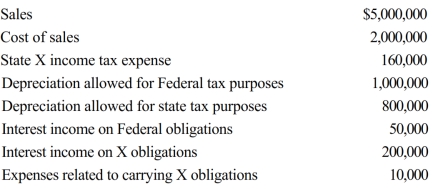

Hill Corporation is subject to tax only in State X. Hill generated the following income and deductions. State income taxes are not deductible for X income tax purposes.

a. The starting point in computing the State X income tax base is Federal taxable income. Derive this amount.

b. Determine Hill's State X taxable income, assuming that interest on X obligations is exempt from State X income tax.

c. Determine Hill's taxable income, assuming that interest on X obligations is subject to State X income tax.

Correct Answer:

Verified

Q142: Match each of the following items with

Q150: Match each of the following items with

Q155: Match each of the following items with

Q157: Match each of the following items with

Q170: Provide the required information for Orange Corporation,

Q172: Compute Still Corporation's State Q taxable income

Q174: Match each of the following items with

Q176: Milt Corporation owns and operates two facilities

Q177: Match each of the following items with

Q178: Condor Corporation generated $450,000 of state taxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents