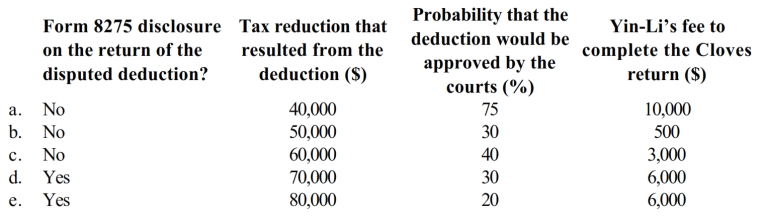

Yin-Li is the preparer of the Form 1120 for Cloves Corporation. On the return, Cloves claimed a deduction that the IRS later disallowed on audit. Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q113: An individual is not subject to an

Q123: A privilege of exists between certain types

Q141: The Four Square Services Corporation estimates that

Q142: Troy Center Ltd. withheld from its employees'

Q145: The taxpayer or a tax advisor may

Q146: LaCharles made a charitable contribution of property

Q149: Evaluate this statement: the audited taxpayer has

Q164: In connection with the taxpayer penalty for

Q168: Describe the potential outcomes to a party

Q169: A taxpayer penalty may be waived if

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents