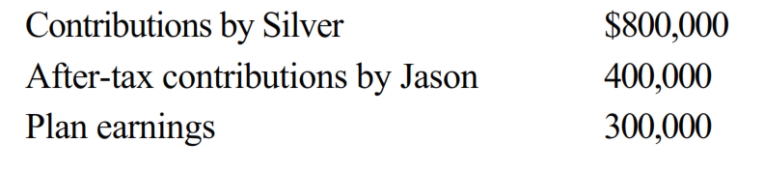

At the time of his death, Jason was a participant in Silver Corporation's qualified pension plan and group term life insurance. The balance of the survivorship feature in his pension plan is:

The term insurance has a maturity value of $100,000. All amounts are paid to Pam, Jason's daughter. One result of these transactions is:

A) Pam must pay income tax on $300,000.

B) Pam must pay income tax on $1,100,000.

C) Jason's gross estate must include $1,200,000.

D) Jason's gross estate must include $1,500,000.

Correct Answer:

Verified

Q81: Classify each of the following statements:

-Hector transfers

Q82: Concerning the Federal estate tax deduction for

Q94: At the time of her death, Amber

Q96: Murray owns an insurance policy on the

Q98: In 2005, Drew creates a trust with

Q100: At the time of her death, Megan

Q103: Classify each of the following statements.

-Homer purchases

Q103: What is the justification for the terminable

Q104: Classify each statement appearing below.

a. No taxable

Q127: Calvin's will passes $800,000 of cash to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents