(Entries to prepare government-wide statements - property tax revenue deferral)

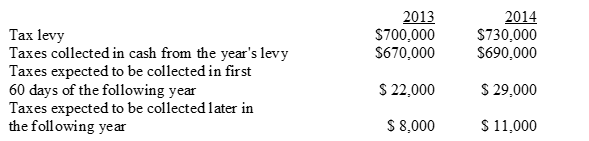

When it prepared its financial statements for calendar year 2012,Watson Town assumed that it would collect all unpaid property taxes during the first 60 days of 2013.As a result,no deferred revenues were reported.The following facts pertain to the property tax revenues for calendar years 2013 and 2014.Make adjusting entries needed to prepare both the fund-level and the government-wide financial statements for 2013 and 2014.Watson Town does not record deferred revenues until it makes end of the year adjustments.

Assume that all taxes expected to be collected in the following year were actually collected when expected.Also assume that all journal entries to record the tax levy,tax collections and so on were made,as appropriate.

Correct Answer:

Verified

Q30: The unrestricted net position balance for a

Q31: On January 1,2012,a county's government-wide financial statements

Q32: Which of the following elements properly will

Q33: Which of the following is a typical

Q34: The City of Bogue provides other postemployment

Q35: Which of the following is the most

Q36: In 2013,Monks Town received a State grant

Q37: During its calendar year 2012,a city issued

Q38: Westenhover City is a municipality that has

Q40: What is the general rule for reporting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents