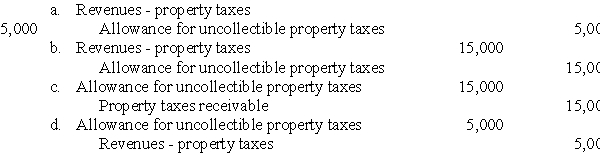

A city uses the allowance method to provide for uncollectible property taxes.At the start of the year,the city established an allowance of $100,000 for uncollectible taxes.During the year,it wrote off $80,000 as uncollectible.At year-end,the city still has some uncollected taxes,but believes it will need an allowance of only $15,000 to cover any receivables that it may need to write off as uncollectible.What adjusting entry should it make?

Correct Answer:

Verified

Q1: The measurement focus used by governmental fund

Q2: On January 1,2013,a city recorded General Fund

Q4: When making its year-end entries,the city's accountant

Q5: A property owner receives a property tax

Q6: A city levies property taxes of $1,050,000,but

Q7: Which of the following best describes the

Q8: A state government receives a grant from

Q9: At the time a government levies the

Q10: At the beginning of the year 2013,a

Q11: A government would refer to its property

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents