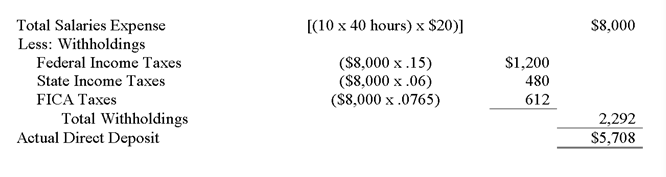

Action Travel has 10 employees each working 40 hours per week and earning $20 an hour.Federal income taxes are withheld at 15% and state income taxes at 6%.FICA taxes are 7.65% and unemployment taxes are 3.8% of the first $7,000 earned per employee.What is the actual direct deposit of payroll for the first week of January?

A) $5,404.

B) $5,708.

C) $4,792.

D) $8,000.

Correct Answer:

Verified

Q30: Action Travel has 10 employees each working

Q31: When a company delivers a product or

Q32: Sales taxes collected by a company on

Q33: Which of the following are not included

Q34: Which of the following is not withheld

Q36: Mike Gundy is a college football coach

Q37: Which of the following are included in

Q38: The sale of gift cards by a

Q39: At times,businesses require advance payments from customers

Q40: Which of the following is true regarding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents