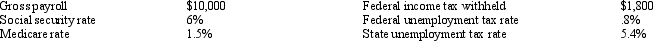

Use the following information to answer the following questions. Assuming no employees are subject to ceilings for their earnings, Jensen Company has the following information for the pay period of January 15 - 31, 20xx. Assuming that all wages are subject to federal and state unemployment taxes, the Payroll Taxes Expense would be recorded as:

Assuming that all wages are subject to federal and state unemployment taxes, the Payroll Taxes Expense would be recorded as:

A) $1,370

B) $750

C) $620

D) $2,870

Correct Answer:

Verified

Q77: Which of the following would be used

Q97: The employee earnings record would contain which

Q104: Assume that social security taxes are payable

Q105: During its first year of operations, a

Q107: An employee receives an hourly rate of

Q109: A pension plan which requires the employer

Q110: An employee receives an hourly rate of

Q110: The following totals for the month of

Q113: A pension plan which promises employees a

Q115: Vacation pay payable is reported on the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents