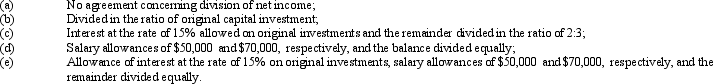

Holly and Luke formed a partnership, investing $240,000 and $80,000, respectively. Determine their participation in the year's net income of $200,000 under each of the following independent assumptions:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q168: The partnership of Abraham Associates began operations

Q169: Jeff Layton, sole proprietor of a hardware

Q169: Emerson and Dakota formed a partnership dividing

Q170: Easy Sailing, LLC provides repair services for

Q175: Gleason invested $90,000 in the James and

Q175: Sharp and Townson had capital balances of

Q176: Gavin invested $45,000 in the Jason and

Q177: Sharp and Townson had capital balances of

Q180: Prior to liquidating their partnership, Porter and

Q194: Malcolm has a capital balance of $90,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents