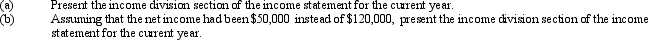

.Daja and Whitnee had capital balances of $140,000 and $160,000 respectively at the beginning of the current fiscal year. The articles of partnership provide for salary allowances of $25,000 and $35,000 respectively, an allowance of interest at 12% on the capital balances at the beginning of the year, with the remaining net income divided equally. Net income for the current year was $120,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q133: Immediately prior to the admission of Allen,

Q142: Jackson and Campbell have capital balances of

Q143: Aaron and Kim form a partnership by

Q152: Partners Ken and Macki each have a

Q153: Jackson and Campbell have capital balances of

Q162: Gentry, sole proprietor of a hardware business,

Q163: Emerson and Dakota formed a partnership dividing

Q164: Match each statement to the item listed

Q166: Top Notch, LLC provides repair services for

Q196: Prior to liquidating their partnership, Craig and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents