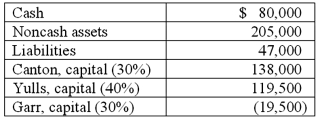

As of January 1, 2011, the partnership of Canton, Yulls, and Garr had the following account balances and percentages for the sharing of profits and losses:  The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $10,000.

The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $10,000.

How much cash should each partner receive at this time, pursuant to a proposed schedule of liquidation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: As of January 1, 2011, the partnership

Q45: On January 1, 2011, the partners of

Q46: On January 1, 2011, the partners of

Q47: The Amos, Billings, and Cleaver partnership had

Q49: As of January 1, 2011, the partnership

Q53: Hardin, Sutton, and Williams have operated a

Q57: The Albert, Boynton, and Creamer partnership was

Q57: Why is a Schedule of Liquidation prepared?

Q60: What financial schedule would be prepared for

Q71: What is a safe cash payment?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents