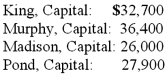

A partnership held three assets: Cash, $13,000; Land, $45,000; and a Building, $65,000. There were no recorded liabilities. The partners anticipated that expenses required to liquidate their partnership would amount to $6,000. Capital balances were as follows:  The partners shared profits and losses 30:30:20:20, respectively.

The partners shared profits and losses 30:30:20:20, respectively.

Required:

Prepare a proposed schedule of liquidation, showing how cash could be safely distributed to the partners at this time.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Which one of the following statements is

Q23: Which of the following statements is true

Q25: A local partnership has assets of cash

Q25: The partnership of Rayne, Marin, and Fulton

Q37: A local partnership has assets of cash

Q43: As of January 1, 2011, the partnership

Q45: On January 1, 2011, the partners of

Q46: On January 1, 2011, the partners of

Q47: For a partnership, how should liquidation gains

Q71: What is a safe cash payment?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents