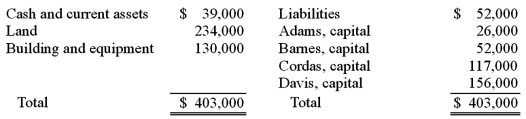

The ABCD Partnership has the following balance sheet at January 1, 2010, prior to the admission of new partner, Eden.  Eden acquired a 20% interest in the partnership by contributing a total of $71,500 directly to the other four partners. Goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: Adams, 15%; Barnes, 35%; Cordas, 30%; and Davis, 20%. After Eden made his investment, what were the individual capital balances?

Eden acquired a 20% interest in the partnership by contributing a total of $71,500 directly to the other four partners. Goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: Adams, 15%; Barnes, 35%; Cordas, 30%; and Davis, 20%. After Eden made his investment, what were the individual capital balances?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Donald, Anne, and Todd have the following

Q77: Jipsom and Klark were partners with capital

Q80: Determine the balance in both capital accounts

Q81: Assume the partnership of Howell, Madrid, and

Q82: On January 1, 2011, Lamb and Mona

Q83: Assume the partnership of Howell, Madrid, and

Q84: Assume the partnership of Dean, Hardin, and

Q87: Under what circumstances does a partner's balance

Q88: Brown and Green are forming a business

Q89: For what events or conditions should the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents