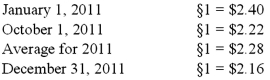

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2011 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2012. A building was then purchased for §170,000 on January 1, 2011. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2011. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:  Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Contrast the purpose of remeasurement with the

Q88: Boerkian Co. started 2011 with two assets:

Q89: Perkle Co. owned a subsidiary in Belgium;

Q90: On January 1, 2011, Fandu Corp. began

Q91: Ginvold Co. began operating a subsidiary in

Q92: Ginvold Co. began operating a subsidiary in

Q93: What is the justification for the remeasurement

Q93: Boerkian Co. started 2011 with two assets:

Q97: Boerkian Co. started 2011 with two assets:

Q100: Under what circumstances would the remeasurement of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents