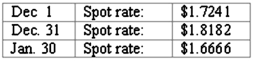

Norton Co., a U.S. corporation, sold inventory on December 1, 2011, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:  What amount of foreign exchange gain or loss should be recorded on December 31?

What amount of foreign exchange gain or loss should be recorded on December 31?

A) $300 gain.

B) $300 loss.

C) $0.

D) $941 loss.

E) $941 gain.

Correct Answer:

Verified

Q3: Meisner Co.ordered parts costing §100,000 for a

Q6: Belsen purchased inventory on December 1, 2010.

Q7: On June 1, CamCo received a signed

Q8: Car Corp. (a U.S.-based company) sold parts

Q10: Mills Inc. had a receivable from a

Q11: The forward rate may be defined as

A)

Q11: Pigskin Co., a U.S. corporation, sold inventory

Q12: Brisco Bricks purchases raw material from its

Q13: Car Corp. (a U.S.-based company) sold parts

Q14: Norton Co., a U.S. corporation, sold inventory

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents