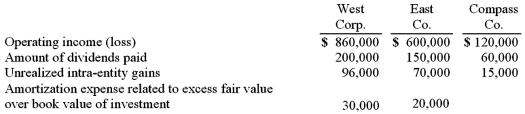

West Corp. owned 70% of the voting common stock of East Co. East owned 60% of Compass Co. West and East both used the initial value method to account for their investments. The following information was available from the financial statements and records of the three companies:  Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. The accrual-based income of East Co. is calculated to be

Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. The accrual-based income of East Co. is calculated to be

A) $385,700.

B) $581,000.

C) $557,000.

D) $551,000.

E) $707,000.

Correct Answer:

Verified

Q2: Buckette Co. owned 60% of Shuvelle Corp.

Q3: In a tax-free business combination,

A) the income

Q11: Beagle Co. owned 80% of Maroon Corp.

Q13: Buckette Co. owned 60% of Shuvelle Corp.

Q13: River Co. owned 80% of Boat Inc.

Q15: West Corp. owned 70% of the voting

Q18: West Corp. owned 70% of the voting

Q19: River Co. owned 80% of Boat Inc.

Q20: Prescott Corp. owned 90% of Bell Inc.,

Q21: Hardford Corp. held 80% of Inglestone Inc.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents