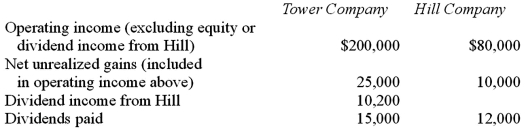

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. Each company's operating and dividend income for the current time period follow, as well as the effects of unrealized gains. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.  Compute accrual-based consolidated net income.

Compute accrual-based consolidated net income.

A) $280,000.

B) $245,000.

C) $200,000.

D) $255,200.

E) $290,200.

Correct Answer:

Verified

Q24: Beagle Co. owned 80% of Maroon Corp.

Q25: On January 1, 2010, Jones Company bought

Q27: Which of the following statements is true

Q28: Hardford Corp. held 80% of Inglestone Inc.

Q29: The benefits of filing a consolidated tax

Q29: Which of the following statements is true

Q29: Hardford Corp. held 80% of Inglestone Inc.

Q30: On January 1, 2010, Jones Company bought

Q31: Chase Company owns 80% of Lawrence Company

Q38: When indirect control is present, which of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents