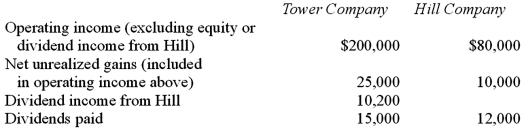

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. Each company's operating and dividend income for the current time period follow, as well as the effects of unrealized gains. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.  Using percentage allocation method, how much income tax expense is assigned to Hill?

Using percentage allocation method, how much income tax expense is assigned to Hill?

A) $21,000.

B) $24,000.

C) $20,400.

D) $17,400.

E) $0.

Correct Answer:

Verified

Q46: White Company owns 60% of Cody Company.

Q47: On January 1, 2011, a subsidiary buys

Q48: White Company owns 60% of Cody Company.

Q51: Woods Company has one depreciable asset valued

Q52: White Company owns 60% of Cody Company.

Q54: Which of the following statements is true

Q54: Tower Company owns 85% of Hill Company.

Q55: Why might a consolidated group file separate

Q58: How is goodwill amortized?

A) It is not

Q60: According to International Financial Reporting Standards: In

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents