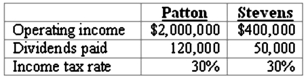

Patton's operating income excludes income from the investment in Stevens, but includes $150,000 of unrealized gains on intra-entity transfers of inventory. Patton uses the initial value method to account for the investment in Stevens.

Patton's operating income excludes income from the investment in Stevens, but includes $150,000 of unrealized gains on intra-entity transfers of inventory. Patton uses the initial value method to account for the investment in Stevens.

Assume Patton owns 90 percent of the voting stock of Stevens and they each file separate income tax returns. What amount of total income tax would be paid?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q93: Tate, Inc. owns 80 percent of Jeffrey,

Q101: On January 1, 2010, Mace Co. acquired

Q102: Jull Corp. owned 80% of Solaver Co.

Q105: On January 1, 2010, Mace Co. acquired

Q106: Jull Corp. owned 80% of Solaver Co.

Q107: Dice Inc. owns 40% of the outstanding

Q108: For each of the following situations, select

Q111: Kurton Inc. owned 90% of Luvyn Corp.'s

Q113: What are the essential criteria for including

Q119: What term is used to describe a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents