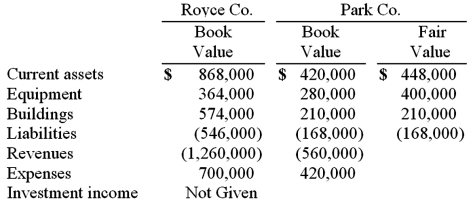

Royce Co. acquired 60% of Park Co. for $420,000 on December 31, 2010 when Park's book value was $560,000. The Royce stock was not actively traded. On the date of acquisition, Park had equipment (with a ten-year life) that was undervalued in the financial records by $140,000. One year later, the following selected figures were reported by the two companies. Additionally, no dividends have been paid.  What is the non-controlling interest's share of the subsidiary's net income for the year ended December 31, 2011 and what is the ending balance of the non-controlling interest in the subsidiary at December 31, 2011?

What is the non-controlling interest's share of the subsidiary's net income for the year ended December 31, 2011 and what is the ending balance of the non-controlling interest in the subsidiary at December 31, 2011?

A) $56,000 and $280,000.

B) $50,400 and $218,400.

C) $56,000 and $224,000.

D) $56,000 and $336,000.

E) $50,400 and $330,400.

Correct Answer:

Verified

Q23: When consolidating a subsidiary that was acquired

Q25: When a parent uses the equity method

Q29: On January 1, 2010, Palk Corp. and

Q32: On January 1, 2010, Palk Corp. and

Q33: Jax Company uses the acquisition method for

Q34: Which of the following statements is false

Q35: When a parent uses the partial equity

Q38: Royce Co. acquired 60% of Park Co.

Q39: In a step acquisition, which of the

Q39: Royce Co. acquired 60% of Park Co.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents