On January 1, 2011, John Doe Enterprises (JDE) acquired a 55% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share). At the time of the acquisition, BMI's book value was $16,970,000.

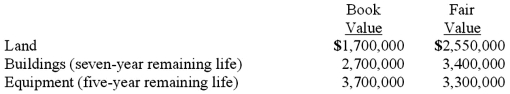

On January 1, JDE stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. BMI had the following balances on January 1, 2011.  For internal reporting purposes, JDE employed the equity method to account for this investment.

For internal reporting purposes, JDE employed the equity method to account for this investment.

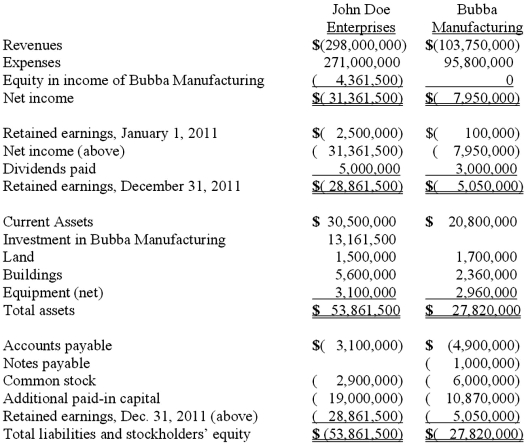

The following account balances are for the year ending December 31, 2011 for both companies.  Required:

Required:

Prepare a consolidation worksheet for this business combination. Assume goodwill has been reviewed and there is no goodwill impairment.

Consolidation Worksheet for John Doe Enterprises and Bubba Manufacturing at 12/31/11.

Correct Answer:

Verified

Q102: Caldwell Inc. acquired 65% of Club Corp.

Q104: Caldwell Inc. acquired 65% of Club Corp.

Q106: On January 1, 2011, John Doe Enterprises

Q106: Tosco Co. paid $540,000 for 80% of

Q107: Select True (T) or False (F) for

Q108: Alonzo Co.acquired 60% of Beazley Corp.by paying

Q109: On January 1, 2010, Glenville Co. acquired

Q111: Pennant Corp. owns 70% of the common

Q113: On January 1, 2009, Vacker Co. acquired

Q114: On January 1, 2011, Elva Corp. paid

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents