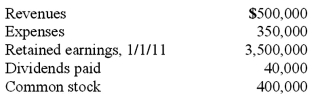

McLaughlin, Inc. acquires 70 percent of Ellis Corporation on September 1, 2010, and an additional 10 percent on November 1, 2011. Annual amortization of $8,400 attributed to the controlling interest relates to the first acquisition. Ellis reports the following figures for 2011:  Without regard for this investment, McLaughlin earns $480,000 in net income ($840,000 revenues less $360,000 expenses; incurred evenly through the year) during 2011.

Without regard for this investment, McLaughlin earns $480,000 in net income ($840,000 revenues less $360,000 expenses; incurred evenly through the year) during 2011.

Required: Prepare a schedule of consolidated net income and apportionment to non-controlling and controlling interests for 2011.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: One company buys a controlling interest in

Q99: Pell Company acquires 80% of Demers Company

Q100: Pell Company acquires 80% of Demers Company

Q101: On January 1, 2010, Jannison Inc. acquired

Q103: On January 1, 2010, Jannison Inc. acquired

Q104: On January 1, 2010, Jannison Inc. acquired

Q105: On January 1, 2010, Glenville Co. acquired

Q106: On January 1, 2011, John Doe Enterprises

Q107: Select True (T) or False (F) for

Q118: How does a parent company account for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents