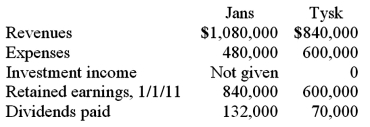

Jans Inc. acquired all of the outstanding common stock of Tysk Corp. on January 1, 2009, for $372,000. Equipment with a ten-year life was undervalued on Tysk's financial records by $46,000. Tysk also owned an unrecorded customer list with an assessed fair value of $67,000 and an estimated remaining life of five years. Tysk earned reported net income of $180,000 in 2009 and $216,000 in 2010. Dividends of $70,000 were paid in each of these two years. Selected account balances as of December 31, 2011, for the two companies follow.  If the equity method had been applied, what would be the Investment in Tysk Corp. account balance within the records of Jans at the end of 2011?

If the equity method had been applied, what would be the Investment in Tysk Corp. account balance within the records of Jans at the end of 2011?

A) $612,100.

B) $744,000.

C) $774,150.

D) $372,000.

E) $844,150.

Correct Answer:

Verified

Q24: According to GAAP regarding amortization of goodwill

Q24: Which of the following is false regarding

Q30: Under the initial value method, when accounting

Q31: Perry Company acquires 100% of the stock

Q31: When consolidating a subsidiary under the equity

Q32: Factors that should be considered in determining

Q36: When a company applies the partial equity

Q38: When a company applies the initial value

Q39: Under the partial equity method of accounting

Q39: Perry Company acquires 100% of the stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents