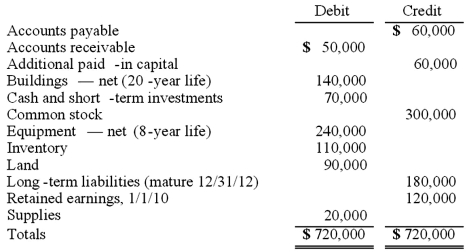

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2010. As of that date, Jackson had the following trial balance:  During 2010, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2011, Jackson reported net income of $132,000 while paying dividends of $36,000.

During 2010, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2011, Jackson reported net income of $132,000 while paying dividends of $36,000.

Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2010, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.

Matthews decided to use the equity method for this investment.

Required:

(A.) Prepare consolidation worksheet entries for December 31, 2010.

(B.) Prepare consolidation worksheet entries for December 31, 2011.

Correct Answer:

Verified

Q108: Hanson Co. acquired all of the common

Q109: Jaynes Inc. acquired all of Aaron Co.'s

Q110: Fesler Inc. acquired all of the outstanding

Q111: Utah Inc. acquired all of the outstanding

Q112: Jaynes Inc. acquired all of Aaron Co.'s

Q114: Fesler Inc. acquired all of the outstanding

Q115: Jaynes Inc. acquired all of Aaron Co.'s

Q116: On 4/1/09, Sey Mold Corporation acquired 100%

Q117: Fesler Inc. acquired all of the outstanding

Q118: Jaynes Inc. acquired all of Aaron Co.'s

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents