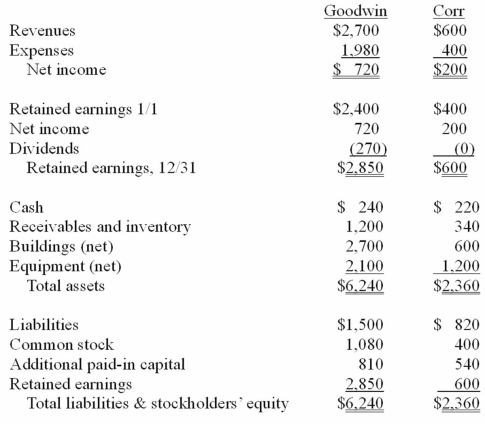

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated additional paid-in capital at December 31, 20X1.

A) $810.

B) $1,350.

C) $1,675.

D) $1,910.

E) $1,875.

Correct Answer:

Verified

Q41: Carnes has the following account balances as

Q42: Carnes has the following account balances as

Q43: The financial statements for Goodwin, Inc., and

Q44: The financial balances for the Atwood Company

Q45: On January 1, 20X1, the Moody Company

Q47: On January 1, 20X1, the Moody Company

Q48: On January 1, 20X1, the Moody Company

Q49: The financial balances for the Atwood Company

Q50: On January 1, 20X1, the Moody Company

Q51: The financial statements for Goodwin, Inc., and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents