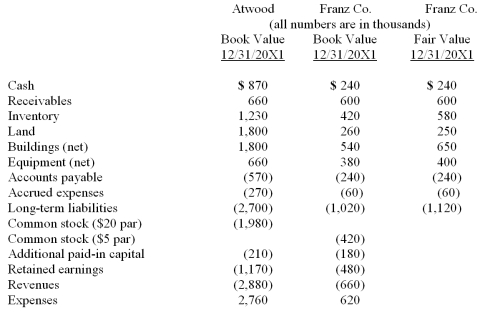

The financial balances for the Atwood Company and the Franz Company as of December 31, 20X1, are presented below. Also included are the fair values for Franz Company's net assets.  Note: Parenthesis indicate a credit balance Assume an acquisition business combination took place at December 31, 20X1. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

Note: Parenthesis indicate a credit balance Assume an acquisition business combination took place at December 31, 20X1. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

Compute consolidated land at the date of the acquisition.

A) $2,060.

B) $1,800.

C) $260.

D) $2,050.

E) $2,070.

Correct Answer:

Verified

Q62: The financial balances for the Atwood Company

Q63: Presented below are the financial balances for

Q64: Presented below are the financial balances for

Q65: The financial balances for the Atwood Company

Q66: Presented below are the financial balances for

Q68: Presented below are the financial balances for

Q69: The financial balances for the Atwood Company

Q70: The financial balances for the Atwood Company

Q71: The financial balances for the Atwood Company

Q72: Presented below are the financial balances for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents