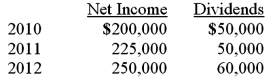

On January 1, 2010, Mehan, Incorporated purchased 15,000 shares of Cook Company for $150,000 giving Mehan a 15% ownership of Cook. On January 1, 2011 Mehan purchased an additional 25,000 shares (25%) of Cook for $300,000. This last purchase gave Mehan the ability to apply significant influence over Cook. The book value of Cook on January 1, 2010, was $1,000,000. The book value of Cook on January 1, 2011, was $1,150,000. Any excess of cost over book value for this second transaction is assigned to a database and amortized over five years. Cook reports net income and dividends as follows. These amounts are assumed to have occurred evenly throughout the years:  On April 1, 2012, just after its first dividend receipt, Mehan sells 10,000 shares of its investment.

On April 1, 2012, just after its first dividend receipt, Mehan sells 10,000 shares of its investment.

What is the balance in the investment account at December 31, 2010?

A) $150,000.

B) $172,500.

C) $180,000.

D) $157,500.

E) $170,000

Correct Answer:

Verified

Q53: On January 4, 2010, Harley, Inc. acquired

Q54: On January 3, 2011, Roberts Company purchased

Q55: On January 1, 2010, Mehan, Incorporated purchased

Q56: On January 4, 2010, Harley, Inc. acquired

Q57: On January 1, 2011, Anderson Company purchased

Q59: On January 1, 2010, Mehan, Incorporated purchased

Q60: On January 1, 2010, Mehan, Incorporated purchased

Q61: Cayman Inc. bought 30% of Maya Company

Q62: Cayman Inc. bought 30% of Maya Company

Q63: On January 1, 2011, Jackie Corp. purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents