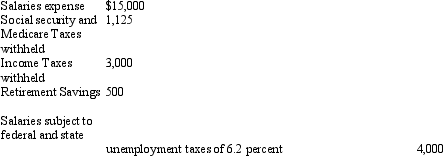

The following totals for the month of June were taken from the payroll register of Young Company:

The entry to record the accrual of employer's payroll taxes would include a

A) debit to Payroll Taxes Expense for $2,498

B) debit to Social Security and Medicare Tax Payable for $2,250

C) debit to Payroll Taxes Expense for $1,373

D) Debit to Payroll Tax Expense for $1,125

Correct Answer:

Verified

Q81: Which of the following is required to

Q89: Payroll taxes levied against employees become liabilities

A)

Q93: The detailed record indicating the data for

Q95: Prior to the last weekly payroll period

Q96: The following totals for the month of

Q101: The journal entry a company uses to

Q102: Use the following information to answer the

Q104: Assume that social security taxes are payable

Q105: During its first year of operations, a

Q139: The journal entry a company uses to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents