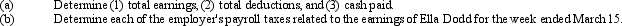

The following information is for employee Ella Dodd for the week ended March 15.

Total hours worked: 48

Rate: $15 per hour,with double time for all hours in excess of 40

Federal income tax withheld: $200

United Fund deduction: $50

Cumulative earnings prior to current week: $6,400

Tax rates:

Social security: 6% on maximum earnings of $100,000.Medicare tax:

1.5% on all earnings.

State unemployment: 3.4% on maximum earnings of $7,000;on employer

Federal unemployment: 0.8% on maximum earnings of $7,000;on employer

Correct Answer:

Verified

Q141: An employee receives an hourly rate of

Q142: The payroll register of Seaside Architecture Company

Q161: Journalize the following transactions for Riley Corporation:

Q162: Journalize the following transactions: Q164: The Core Company had the following assets Q165: Excel Products Inc.pays its employees semimonthly.The summary Q166: Journalize the following entries on the books Q167: On October 1,Ramos Co.signed a $90,000,60-day discounted Q168: The current assets and current liabilities for Q171: Aqua Construction installs swimming pools. They calculate

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents