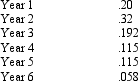

The Nova Company is considering replacing a machine that will cost $240,000.It expects to realize cost savings of $70,000 a year before taxes for each of the next five years.The company will use an accelerated method of depreciation as follows:

At the end of five years,the company expects the machine will have no salvage value.The company has a tax rate of 45 percent and has determined that 12 percent is the appropriate discount rate to use.Prepare an analysis showing the net present value.Indicate what salvage value is necessary of the old machine in order to justify the purchase of the new machine.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Feed the Hungry Foundation

Feed the Hungry Foundation

Q103: An investment that costs $79,100 will reduce

Q104: Describe the steps of the net present

Q105: How does depreciation affect investment decisions?

Q106: Explain how you might analyze a capital

Q108: What is the role of capital expenditure

Q109: Explain how you might analyze a capital

Q110: Explain the problem of just using cash

Q111: Island Grills considering purchasing a new machine

Q112: What is the reasoning behind the separation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents