Use the following to answer questions

Arctic Cat Inc. ,the snowmobile manufacturer,reported the following in its 20X5 annual report to shareholders:

NOTE B - SHORT-TERM INVESTMENTS

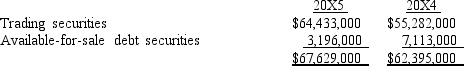

Short-term investments consist primarily of a diversified portfolio of municipal bonds and money market funds and are classified as follows at March 31:

Trading securities consist of $54,608,000 and $41,707,000 invested in various money market funds at March 31,20X5 and 20X4,respectively,while the remainder of trading securities and available-for-sale securities consist primarily of A-rated or higher municipal bond investments.The amortized cost and fair value of debt securities classified as available-for-sale was $3,105,000 and $3,196,000,at March 31,20X5.The unrealized gain on available-for-sale debt securities is reported,net of tax,as a separate component of shareholders' equity.

Trading securities consist of $54,608,000 and $41,707,000 invested in various money market funds at March 31,20X5 and 20X4,respectively,while the remainder of trading securities and available-for-sale securities consist primarily of A-rated or higher municipal bond investments.The amortized cost and fair value of debt securities classified as available-for-sale was $3,105,000 and $3,196,000,at March 31,20X5.The unrealized gain on available-for-sale debt securities is reported,net of tax,as a separate component of shareholders' equity.

Arctic Cat Inc.

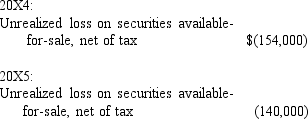

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

Years Ended March 31,

Accumulated Other Comprehensive Income changed by the following amounts:

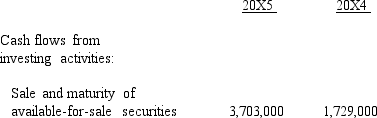

In its 20X4 annual report,Arctic Cat disclosed,"The contractual maturities of available-for-sale debt securities at March 31,20X4,are $3,573,000 within one year and $3,340,000 from one year through five years."

In its 20X4 annual report,Arctic Cat disclosed,"The contractual maturities of available-for-sale debt securities at March 31,20X4,are $3,573,000 within one year and $3,340,000 from one year through five years."

-What gain or loss would be realized if the available for sale securities on Arctic Cat's 3/31/X5 balance sheet were sold immediately for their fair value? Show the journal entry that would record the sale,and show a journal entry to record the effects of the sale on their fair value adjustment at the end of the period (ignore taxes).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q145: Prepare journal entries that Fragrance International recorded

Q146: Assuming a constant tax rate of 40%,what

Q147: On July 1,2016,Silverwood Company purchased for cash

Q148: Krogstad Corporation bought 1,000 shares of Cole

Q149: What was the after-tax realized gain or

Q151: Damon,Inc. ,acquired 25% of Jolie Enterprises for

Q152: On July 1,2016,Clearwater Inc.purchased 6,000 shares of

Q153: During 2016,Largent Enterprises purchased stock as follows:

May

Q154: Matrix,Inc. ,acquired 25% of Neo Enterprises for

Q155: Use the following to answer questions

Arctic

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents