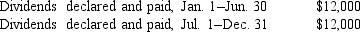

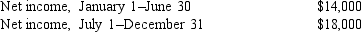

On July 1,2016,Clearwater Inc.purchased 6,000 shares of the outstanding common stock of Mountain Corporation at a cost of $140,000.Mountain had 30,000 shares of outstanding common stock.The total book value and total fair value of Mountain's individual net assets on July 1,2016,are both $700,000.The total fair value of the 30,000 shares of Mountain's common stock on December 31,2016,is $760,000.Both companies have a January through December fiscal year.The following data pertains to Mountain Corporation during 2016:

Required:

(1. )Prepare the necessary entries for 2016 under the equity method (other than for the purchase).

(2. )Prepare any necessary entries for 2016 (other than for the purchase)that would be required if the securities are classified as available for sale.

Correct Answer:

Verified

Q155: Use the following to answer questions

Arctic

Q156: Bentz Corporation bought and sold several securities

Q157: On January 1,2015,Bactin Corporation acquired 10% of

Q158: Bourne,Inc. ,acquired 50% of David Webb Enterprises

Q159: Fredo,Inc. ,purchased 10% of Sonny Enterprises for

Q161: Jaycom Enterprises has invested its excess cash

Q164: Stanhope Associates accounts for the following investments

Q165: Prepare appropriate entry(s)at December 31,2017,and indicate how

Q175: When an investor owns 20% to 50%

Q177: Companies need to consider GAAP regarding fair

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents