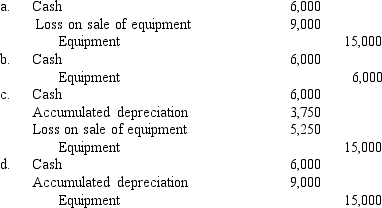

An asset acquired January 1,2016,for $15,000 with an estimated 10-year life and no residual value is being depreciated in an equipment group asset account that has an average service life of eight years.The asset is sold on December 31,2017,for $6,000.The entry to record the sale would be:

Correct Answer:

Verified

Q7: International Financial Reporting Standards (IFRS) require goodwill

Q8: Statutory depletion is the maximum amount of

Q13: According to International Financial Reporting Standards (IFRS),

Q14: Advocates of accelerated depreciation methods argue that

Q18: Once selected for existing assets, a company

Q22: Using the sum-of-the-years'-digits method,depreciation for 2017 and

Q23: Using the double-declining balance method,depreciation for 2017

Q25: Using the straight-line method,depreciation for 2017 and

Q32: By the replacement depreciation method, depreciation is

Q38: In the first year of an asset's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents