Use the following to answer questions

Montana Mining Co.(MMC) paid $200 million for the right to explore and extract rare metals from land owned by the state of Montana.To obtain the rights,MMC agreed to restore the land to a suitable condition for other uses after its exploration and extraction activities.MMC incurred exploration and development costs of $60 million on the project.

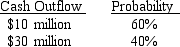

MMC has a credit-adjusted risk free interest rate is 7%.It estimates the possible cash flows for restoring the land,three years after its extraction activities begin,as follows:

-The asset retirement obligation (rounded) that should be recognized by MMC at the beginning of the extraction activities is:

A) $ 8.2 million.

B) $14.7 million.

C) $ 18 million.

D) $ 30 million.

Correct Answer:

Verified

Q26: The exclusive right to benefit from a

Q27: Holiday Laboratories purchased a high-speed industrial centrifuge

Q28: Simpson and Homer Corporation acquired an office

Q29: Assets acquired by the issuance of equity

Q31: Use the following to answer questions

Montana Mining

Q33: If a company incurs disposition obligations as

Q33: The exclusive right to display a symbol

Q34: On July 1,2016,Larkin Co.purchased a $400,000 tract

Q39: Asset retirement obligations:

A) Increase the balance in

Q44: Assets acquired under multi-year deferred payment contracts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents