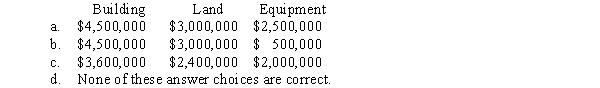

Cantor Corporation acquired a manufacturing facility on four acres of land for a lump-sum price of $8,000,000.The building included used but functional equipment.According to independent appraisals,the fair values were $4,500,000,$3,000,000,and $2,500,000 for the building,land,and equipment,respectively.The initial values of the building,land,and equipment would be:

Correct Answer:

Verified

Q11: The successful efforts method of accounting for

Q14: The interest capitalization period for a self-constructed

Q19: Demolition costs to remove an old building

Q22: Lake Incorporated purchased all of the outstanding

Q22: Grab Manufacturing Co. purchased a 10-ton draw

Q28: Simpson and Homer Corporation acquired an office

Q36: Vijay Inc. purchased a three-acre tract of

Q38: Assets acquired in a lump-sum purchase are

Q39: Asset retirement obligations:

A) Increase the balance in

Q41: When selling property, plant, and equipment for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents