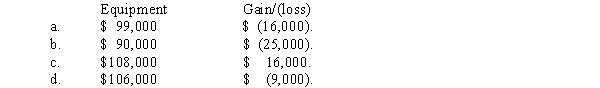

P.Chang & Co.exchanged land and $9,000 cash for equipment.The book value and the fair value of the land were $106,000 and $90,000,respectively.

Chang would record equipment and a gain/(loss)of:

Correct Answer:

Verified

Q41: The basic principle used to value an

Q50: Donated assets are recorded at:

A) Zero (memo

Q57: Assuming that the exchange has commercial substance,Alamos

Q60: Bloomington Inc.exchanged land for equipment and $3,000

Q62: Use the following to answer questions

On

Q63: Average accumulated expenditures for 2017 was:

A)$ 536,000.

B)$1,236,000.

C)$1,200,000.

D)$1,036,000.

Q64: Interest may be capitalized:

A) On routinely manufactured

Q72: In computing capitalized interest, average accumulated expenditures:

A)

Q73: Interest is not capitalized for:

A) Assets that

Q75: The cost of self-constructed fixed assets should:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents