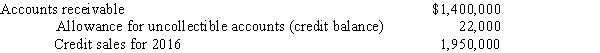

San Mateo Company had the following account balances at December 31,2016,before recording bad debt expense for the year:

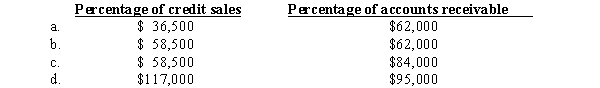

San Mateo is considering the following approaches for estimating bad debts for 2016:

Based on 3% of credit sales

Based on 6% of year-end accounts receivable

What amount should San Mateo charge to bad debt expense at the end of 2016 under each method?

Correct Answer:

Verified

Q53: Tom's Textiles shipped the wrong material to

Q60: What entry would Harvey's make on April

Q61: Calistoga's 2016 bad debt expense is:

A)$1,720.

B)$1,650.

C)$1,505.

D)$1,575.

Q62: The following information relates to Halloran Co.'s

Q63: Calistoga's adjusted allowance for uncollectible accounts at

Q65: As of December 31,2015,Gill Co.reported accounts receivable

Q67: As of January 1,2016,Farley Co.had a credit

Q68: Calistoga's accounts receivable at December 31,2016,are:

A)$467,000.

B)$473,280.

C)$465,280.

D)$469,280.

Q69: If a company uses the balance sheet

Q79: When you use an aging schedule approach

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents