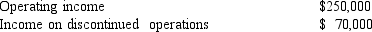

Freda's Florist reported the following before-tax income statement items for the year ended December 31,2016:

All income statement items are subject to a 40% income tax rate.In its 2016 income statement,Freda's separately stated income tax expense and total income tax expense would be:

A) $128,000 and $128,000,respectively.

B) $128,000 and $100,000,respectively.

C) $100,000 and $128,000,respectively.

D) $100,000 and $100,000,respectively.

Correct Answer:

Verified

Q5: Income statements prepared according to both U.S.GAAP

Q7: Earnings quality refers to the ability of

Q8: International Financial Reporting Standards require a company

Q9: Gains, but not losses, from discontinued operations

Q9: Provincial Inc.reported the following before-tax income statement

Q10: Pro forma earnings:

A)Could be considered management's view

Q11: Intraperiod tax allocation is the process of

Q16: Comprehensive income is the total change in

Q19: The direct and indirect methods of reporting

Q33: Intraperiod income tax presentation is primarily a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents