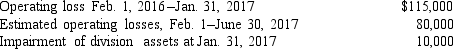

On August 1,2016,Rocket Retailers adopted a plan to discontinue its catalog sales division,which qualifies as a separate component of the business according to GAAP regarding discontinued operations.The disposal of the division was expected to be concluded by June 30,2017.On January 31,2017,Rocket's fiscal year-end,the following information relative to the discontinued division was accumulated:

In its income statement for the year ended January 31,2017,Rocket would report a before-tax loss on discontinued operations of:

A) $115,000.

B) $195,000.

C) $ 65,000.

D) $125,000.

Correct Answer:

Verified

Q27: The division's book value and fair value

Q28: Each of the following would be reported

Q29: On November 1,2016,Jamison Inc.adopted a plan to

Q30: Suppose that the Footwear Division's assets had

Q31: Reporting comprehensive income can be accomplished by

Q33: Which of the following is not true

Q34: The principal benefit of separately reporting discontinued

Q35: In the 2016 income statement for Foxtrot

Q36: Howard Co.'s 2016 income from continuing operations

Q37: The Claxton Company manufactures children's toys and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents