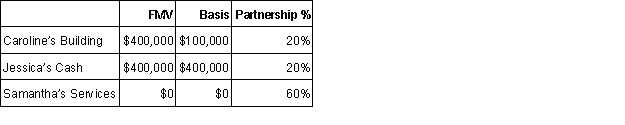

Caroline, Jessica, and Samantha form a partnership. Caroline contributes a building, Jessica contributes cash and Samantha will operate the business.  How much income must Samantha recognize?

How much income must Samantha recognize?

A) $0.

B) $400,000.

C) $480,000.

D) $500,000.

Correct Answer:

Verified

Q25: A guaranteed payment is treated as:

A)A separately

Q27: If Janelle's partnership basis was $5,000 and

Q28: A partner can recognize a loss on

Q29: When a partner increases his or her

Q33: If a partner contributes services on the

Q44: Partner Jamie has a basis of $10,000

Q45: In 2014, Angel contributes land to a

Q48: Sabrina has a $12,000 basis in her

Q52: A partnership has $23,000 of depreciation expense

Q56: Rental income and expenses are treated as:

A)Ordinary

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents