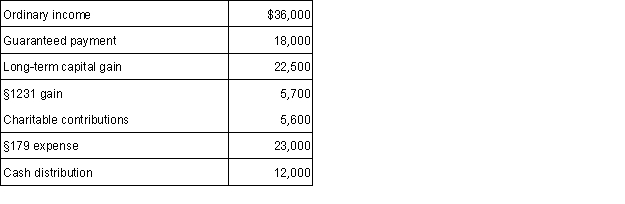

Rita has a beginning basis in a partnership of $43,000. Rita's share of income and expense from the partnership consists of the following amounts:  a. What items are separately stated?

a. What items are separately stated?

b. What is Rita's self-employment income?

c. Calculate Rita's partnership basis at the end of the year.

Correct Answer:

Verified

Q61: Molly has a $15,000 basis in her

Q62: Anna has a $25,000 basis in her

Q65: Latesha contributes a building with a FMV

Q66: Charley is a partner in Charley, Austin,

Q67: Jose purchased a 30% partnership interest for

Q69: When dealing with the liquidation of a

Q70: Callie contributes the following assets to a

Q71: On April 30 of the current year,

Q74: Marty and Blake are equal partners in

Q75: Cameron has a basis in his partnership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents