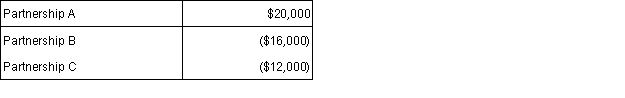

Spencer has an ownership interest in three passive activities. In the current tax year, the activities had the following income and losses:  How much in passive losses can Spencer deduct?

How much in passive losses can Spencer deduct?

A) $0.

B) $12,000.

C) $16,000.

D) $20,000.

Correct Answer:

Verified

Q38: Which of the following increases the taxpayer's

Q43: In 2013, Mary invested $200,000 in a

Q46: Heather purchased furniture and fixtures (7-year property)

Q47: For AMT purposes,the standard deduction and personal

Q48: After computing all tax preferences and AMT

Q49: In 2015, Ethan contributes cash of $50,000

Q50: Denise's AGI is $145,000 before considering her

Q56: When determining whether a limited partnership loss

Q60: Which of the following itemized deductions is

Q68: Identify factors that increase or decrease the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents