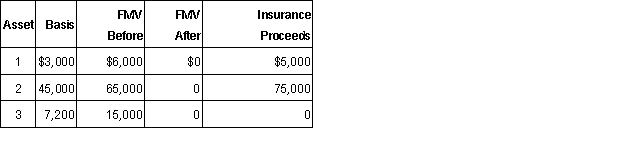

Knox operated a business which was damaged by a hurricane in 2015. His losses were as follows:  a. What is Knox's net casualty loss (if any) assuming his AGI is $85,000 prior the deduction? Assume he properly replaced all assets.

a. What is Knox's net casualty loss (if any) assuming his AGI is $85,000 prior the deduction? Assume he properly replaced all assets.

b. What is his basis in replacement Asset 1 purchased for $8,000 assuming Knox elected the non-recognition of gain from an involuntary conversion?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Louis, who is single, sold his house

Q63: Richard's business is condemned by the state

Q64: Basil, who is single, purchased a house

Q65: A warehouse with an adjusted basis of

Q67: Dr. and Mrs. Spankle purchased a residence

Q68: Edith owns farm land in western Montana.Her

Q69: On July 1, 2015, DJ sold equipment

Q70: On December 28, 2015, Misty sold 300

Q72: On February 12, 2015, Nelson sells stock

Q73: Laverne exchanges a rental beach house with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents