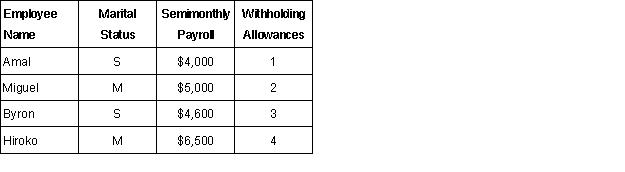

Maeda Company has the following employees on the payroll:  Using the information above, calculate the payroll taxes (FICA, federal withholding) for each employee for one payroll period. Assume that Maeda Company receives the maximum credit for state unemployment contributions. Use the percentage method for calculating FIT.

Using the information above, calculate the payroll taxes (FICA, federal withholding) for each employee for one payroll period. Assume that Maeda Company receives the maximum credit for state unemployment contributions. Use the percentage method for calculating FIT.

Correct Answer:

Verified

Q101: A taxpayer with an AGI of $300,000

Q102: An employer must send Copy A of

Q103: Sandy is a self-employed health information coder.

Q104: Claude works as a teacher during the

Q107: Maeda Company has the following employees on

Q108: Griffith & Associates is trying to determine

Q109: Carolyne earns $150,000 per year. She is

Q111: Jan hired Mike to dog sit for

Q115: Hank received a bonus of $5,000 from

Q118: Failure to furnish a correct TIN to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents