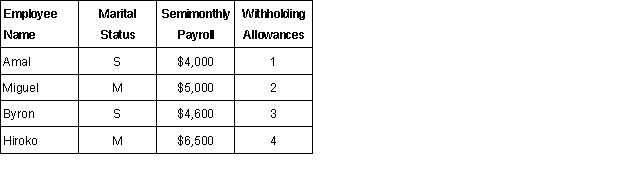

Maeda Company has the following employees on the payroll:  Using the information above, what are the annual amounts that would be used to complete a Form W-2 for Hiroko.

Using the information above, what are the annual amounts that would be used to complete a Form W-2 for Hiroko.

a. Gross Wages:

b. Federal Withholding:

c. Social Security Tax:

d. Medicare Tax:

Correct Answer:

Verified

Q112: Nikki's salary is $209,950 in 2015. How

Q113: Bonita is married and claims four exemptions

Q114: A taxpayer had AGI of $300,000 in

Q115: Joe is paid $975 per week. Using

Q116: Nikki's salary is $209,950 in 2015. She

Q117: K. Kruse Designs has the following employees:

Q118: Kim works part-time for Medical Assistants Inc.,

Q119: Teko earned $109,500 during 2015. Teko is

Q120: GTW Inc., did not make timely deposits

Q122: Maeda Company has the following employees on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents