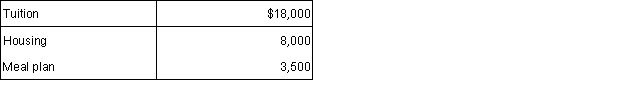

Sam paid the following expenses during October 2015 for his son Aaron's spring 2016 college expenses: Spring 2016 semester begins in January 2016:  In addition, Aaron's uncle paid $500 for college fees on behalf of Aaron directly to the college. Aaron is claimed as Sam's dependent on his tax return. How much of the paid expenses qualify for purposes of the education credit deduction for Sam in 2015?

In addition, Aaron's uncle paid $500 for college fees on behalf of Aaron directly to the college. Aaron is claimed as Sam's dependent on his tax return. How much of the paid expenses qualify for purposes of the education credit deduction for Sam in 2015?

A) $3,500.

B) $11,500.

C) $18,000.

D) $18,500.

Correct Answer:

Verified

Q42: A qualifying individual for the purposes of

Q46: April and Joey are both 74 years

Q51: Sean and Jenny are married,file a joint

Q52: Which of the following statements is not

Q54: Kobe is a single dad with two

Q57: The earned income credit (EIC)is only available

Q59: Which of the following statements is not

Q60: Which of the following statements is not

Q66: In which of the following situations would

Q80: Tina has $93,000 total taxable income,which includes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents