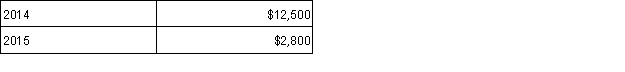

After years of working with the orphanage and the government, Walt and Kim adopted a little girl from China. The adoption process, which became final in January 2015, incurred the following qualified adoption expenses. What amount of adoption credit can Walt and Kim claim and in what year? Assume there is no credit limitation due to their AGI amount.

A) $15,300 in 2014.

B) $12,500 in 2014 and $2,800 in 2015.

C) $13,400 in 2015.

D) $15,300 in 2015.

Correct Answer:

Verified

Q63: Julia and Omar are married and file

Q67: Jesus and Mindy have modified AGI of

Q69: Gina has $39,000 total taxable income,which includes

Q72: Which of the account contributions qualify for

Q73: Warren and Erika paid $9,300 in qualified

Q73: Shawn and Dahlia are married; both work

Q74: Waseem has $103,000 total taxable income,which includes

Q76: Dean and Sue are married filing jointly

Q77: Sandra is single and her son Julius

Q79: Which of the following conditions must be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents