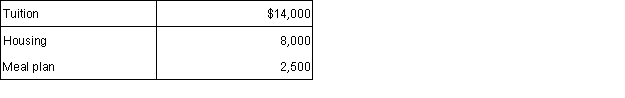

Kim paid the following expenses during November 2015 for her son Joshua's spring 2015 expenses, which begins in January 2016:  In addition, Kim's sister paid $800 for college fees on behalf of Joshua directly to the college. Joshua is claimed as Kim's dependent on her tax return. How much of the paid expenses qualify for purposes of the education credit deduction for Kim in 2015?

In addition, Kim's sister paid $800 for college fees on behalf of Joshua directly to the college. Joshua is claimed as Kim's dependent on her tax return. How much of the paid expenses qualify for purposes of the education credit deduction for Kim in 2015?

A) $8,000.

B) $14,800.

C) $24,000.

D) $28,500.

Correct Answer:

Verified

Q82: Guillermo and Felicia are married,file a joint

Q84: Sam is a single father with two

Q86: Which of the following statements is true

Q92: Tuan and Marisa are married,file a joint

Q95: George is a single father who has

Q96: Arturo and Deena are married with two

Q97: Which of the following statements is false

Q97: Sam and Edna are married with three

Q100: Which of the following is not a

Q116: Noah and Olivia have two boys,Jordan,age 6

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents