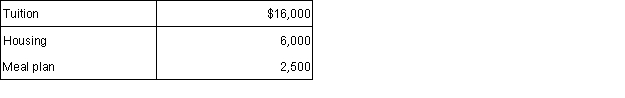

Lupe paid the following expenses during December 2015 for her son David's spring 2016 college expenses. The semester begins in February 2016.  In addition, David's grandfather paid $500 in fees on behalf of David directly to the college. David is claimed as a dependent on Lupe's tax return. How much of the above expenses qualify for purposes of Lupe's education credit deduction in 2015?

In addition, David's grandfather paid $500 in fees on behalf of David directly to the college. David is claimed as a dependent on Lupe's tax return. How much of the above expenses qualify for purposes of Lupe's education credit deduction in 2015?

A) $8,500.

B) $16,000.

C) $16,500.

D) $24,500.

Correct Answer:

Verified

Q102: Jillian is single and her son,Parker is

Q103: Arin and Bo have $74,000 total taxable

Q104: Matt is a single father.He paid $5,000

Q105: Brian and Clara paid $4,350 in foreign

Q108: Patricia is single and her son Quinn

Q109: Casey and Lupe have AGI of $125,000.They

Q110: Andrew and Eunice are married filing jointly

Q111: Adrienne has total taxable income of $93,000

Q112: Andrew and Marina are married filing joint

Q113: Which of the following statements regarding adoption

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents