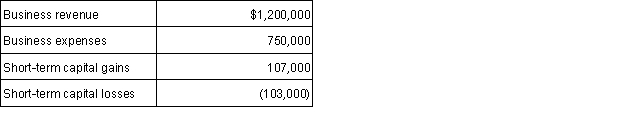

Ariel, Bob, Candice and Dmitri are equal partners in a local ski resort. The resort reports the following items for the current year:  Each partner receives a Schedule K-1 with one-fourth of the preceding items reported to him/her. How must each individual report these results on his/her Form 1040?

Each partner receives a Schedule K-1 with one-fourth of the preceding items reported to him/her. How must each individual report these results on his/her Form 1040?

A) $100,000 income on Schedule E; $1,000 short-term capital gain on Schedule D

B) $112,500 income on Schedule E; $1,000 short-term capital gain on Schedule D

C) $300,000 income on Schedule E; $26,750 short-term capital gain on Schedule D

D) $1,200,000 income on Schedule E; $107,000 short-term capital gain on Schedule D

Correct Answer:

Verified

Q61: Which of the following entity(ies)is(are)considered flow-through?

A)C corporation

B)Sole

Q67: Which of the following statements is true

Q68: Samantha is a full-time author and recently

Q72: Royalties can be earned from allowing others

Q74: Stephen and Joy own a duplex in

Q75: When royalties are paid,at the end of

Q81: Lori and Donald own a condominium in

Q106: What must the owner of rental property

Q111: When reporting the income and expenses of

Q115: What are the criteria that determine an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents