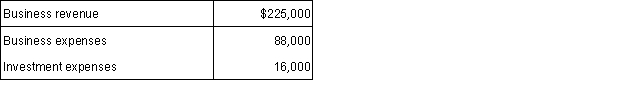

Owen and Jessica own and operate an S corporation. Each is a 50% owner. The business reports the following results:  How do Owen and Jessica report these items for tax purposes?

How do Owen and Jessica report these items for tax purposes?

A) $68,500 income on Schedule E; $16,000 investment expense on Schedule D

B) $68,500 income on Schedule E; $8,000 investment expense on Schedule A

C) $137,000 income on Schedule E; $88,000 investment expense on Schedule A

D) $225,000 income on Schedule E; $16,000 investment expense on Schedule A

Correct Answer:

Verified

Q41: Jane and Don own a ski chalet

Q48: Mario owns a home in Park City,Utah,that

Q60: Lupe rented her personal residence for 13

Q61: Reggie and Bebe own an apartment building

Q64: Alex, Ellen and Nicolas are equal partners

Q66: Jeremy and Gladys own a cabin in

Q71: From which of the following flow-through entities

Q74: Darius and Chantal own a cabin in

Q76: Which of the following statements is incorrect

Q78: On June 1st of the current year,Kayla

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents